Greetings and Salutations!

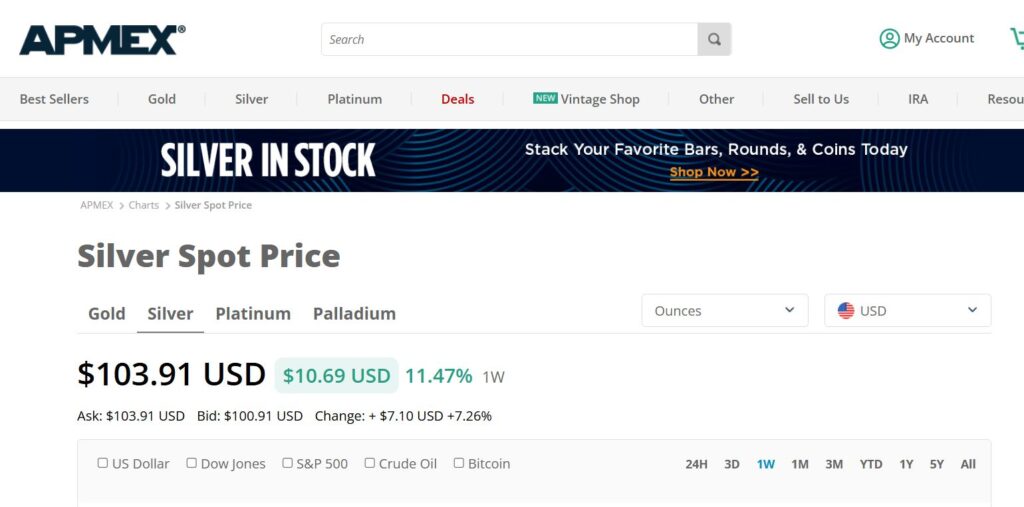

Well, THAT escalated quickly:

Now we’re into the nitty-gritty of currency

Me? I sold off 3 individual grams of gold yesterday when silver was under $99 and reinvested it to oz coins.

Not a bad play IMO.

I got $157 per gram (individual) and ended up with 4oz of Silver Rounds

Which today already in many respects paid off already.

NOW

Next on the list:

Things are ‘squirrelly’ to say the least.

My Mining stonks are doing well for me… I’m back on the positive side of the investment, but that don’t mean shytte long term.

MY question is what I’m looking at with my last bit of actual gold. I have a 1/10oz Canadian Maple Leaf. Numismatically it’s about $700. HOWEVER this market seems to ONLY be dealing with spot.

And who can blame them.

Coin collecting is nice, and it’s good when the coin limitations and valuations are limited. However… during volatility timeframes like this? Spot is IT. The end-all-be-all

Hence my divestures of the gold

3 individual gram?

Nice for the long run

In a collapse?

Nosomucho

People are going to be like “Uh… yeah… a single gram of gold… BFD… what else you got?” with the follow on attempted loot grab and violence.

Better to keep the goldbacks (which yet may take on a valuation in common fashion) AND/OR as I’m doing, which is divest the gold in favor of a more recognizable and intuitive valuation from the morons I might have to deal with Post Fiat-Bux situations…

Tough call…

But I do know that 8 months ago I bought (against my inner voice and Sapper’s advise) a roll of near-uncirculated Mercury 90% dimes… $5 worth… at $265 for the roll. The rationale was that silver was looking at an upswing (I had no idea how correct I was in that) and that I could do the “Sezzle Finance” thing of $64+/- a month for a few months…

The same exact roll is NOW selling for $499.99 each

Sometimes you get lucky.

So make of it what you will

Me? I plan on making more $$ on my trades IF I can.

And BTW: It’s the Nukular Redhead’s Eighth Birfday today!

OMFG

WHen the hell did they grow up so quickly???

So more later

Big Country

Great shot with the Redhead and Buc-ee.

Thanks

check this out!

https://nopel-0.com/m1337/

AND they’re reasonably priced too! 👍

She gets cuter by the year. Congrats on keeping up with her – you’re a rock in her world.

The silver thing is indeed crazy, as are other precious metals. I like using them in my work, but the cost factor is getting prohibitive. Newer ceramics are an alternative, but they don’t do everything and have some limitations.

the way the metals are moving its gonna be more like Silver and Copper vs Gold and Silver people will be forced to use for daily type bartering, gold will be for house/car purchases. Sucks to hear about the issue with the Maple leaf coins, I used to listen to a guy on the Patrick Timpone show years back, he dealt mostly with numismatic gold due to the past confiscation issues, I think he got St Guaden’s (sp) a lot. Myself, I figured since im not super up on the numismatic side of things I’d prob get hosed, so I just deal with spot coins like the maple leafs, eagles, etc. more recognizable. With the price of silver now, I wonder if banks are getting cleaned out of change with ppl sifting thru them for junk silver? Esp ones like 50 cent pieces that dont circulate much I figure have to have better odds than say dimes or quarters. The ROI as far as time got a lot more profitable nowadays.

Numismatic is they price they’ll sell it to you, melt is the price they will buy it from you unless it is truly a collectible coin in demand.

Most of my silver stacking was done in small denomination “junk” coins – quarters and dimes. The reasoning for that is it would be a lot easier to barter say, 10 cents silver for something than to try to use a gold coin or a piece off a gold bar. Gold is the store of value for after things have settled down and it is time to rebuild. Unless you buy some gold chain and trade it that way, or jewelry. As guys who wrote about surviving Bosnia and other places, it is easier to bribe someone with “grandma’s old wedding band” than it is to pull out a bar or coin – then they wonder if you have more.

That said, I need to find an honest/fair coin dealer who will give me a decent price on some old silver dollars.

Just got back from my dealer.

Did the gold for silver switcheroo. Got $550 for the coin (above melt value as it WAS a collectible and marked). Walked out with 4-1oz rounds and some cash to fill the tank on The Boat and get me a nice dinner out tonight. Talking to my dealer, he said that it was probably a solid move as IF/WHEN/AS silver keeps shooting parabolically up (as it can) gold has almost peaked as they CAN’T allow it to do the same, not without blowing over the financial house o’cards they built.

With silver, the justification for high pricing can be outrageous industrial demand whereas Gold is the ‘backing’ behind all the false fiatbux.

Gold HAS to stay relatively stabilized or everything goes out the window.

So silver at $500 per? I could see that by July at the current rate.

If it does, I’ll have made BANK on the 4 rounds I got today.

Nice closing photo – that grandkid is precious. You are a fortunate grandpa.

I bought 20 Liberty silver dollars for about $800 – they’re 2021 minted. I thought that was a lot of scratch but I liked them. Now they’re apparently worth north of 2K. I’m drinking to that.

Happy birthday Red!

I have scooped up uhh, more than one circulated roll of dimes, as I could afford.

Thought to dig them out & throw them on the scale. Then I went through the bits and bobs of other single coins.

Wow. I think I’ll sit on them for a bit.

Right now refineries don’t want sterling or junk silver to process. They just do not have time to separate out the copper as their industrial customers want product NOW before the price goes higher. You can find dealers selling 90% silver coins at low premiums as they can’t offload it to the refiners. US coins would be valuable in a crash as they are recognizable as money and prices can be adjusted to reflect their value. And if you take the current fiat value you can see that you can fill up your gas tank at 60’s prices (face value). One benefit of the soaring silver price is that the last 2 orders I’ve made had delays on delivery. By the time I received my coins the price had gone up enough to cover the premium and shipping (I use secure, signature required method). Wild times. BC, those goldbacks are legal currency in Florida now anywhere that will accept them. I expect that list of retailers to grow quickly. You’ll know things are really bad when Publix starts accepting them.

EIGHT !! How the hell did that happen ?? HAPPY BIRTHDAY TO THE NUCLEAR REDHEAD

Red is growing like a weed and also looks much less snaggle toothed than early pics. Oil your shotgun up, BC, before long you’ll need it for boyfriends. Make sure to give them the ID grin you use when you meet them and mention how you are really struggling with your PTSD.

I have a bit of gold, a fair amount of .999 rounds and the largest stash is junk. US coins and extremely useful for smaller things. Some people used to say I was crazy for buying PMs. They aren’t saying much now. Also a reasonable supply of pre-82 pennies, wish I had more. I can see a dime buying 3 loaves of fresh baked bread and possibly also some eggs and perhaps a bit of meat. A quarter definitely would. Think early 1900s. Fiat bux will be useful for starting fires or dire emergency toilet paper. Good move on the gold to silver Big Guy. Silver is growing much faster right now. The gold/silver ratio is finally rebalancing.

I count silver sheep jumping over the bed when I fall asleep these days. And at the risk of being redundant, Khazarian banksters can kiss my Whytte Northern European ass, the side with the carbuncle on it.

Nos vemos, compadres.

Shooter